CAPAM

Consulting

CAPAM Consulting is an Education Based Consulting (EBC) firm aiming to assist companies and consultants, particularly small and medium-sized businesses (SMBs), in navigating the intricate maze of transfer pricing through our comprehensive EBC solutions and products.

- Trusted

- Experienced

- Professional

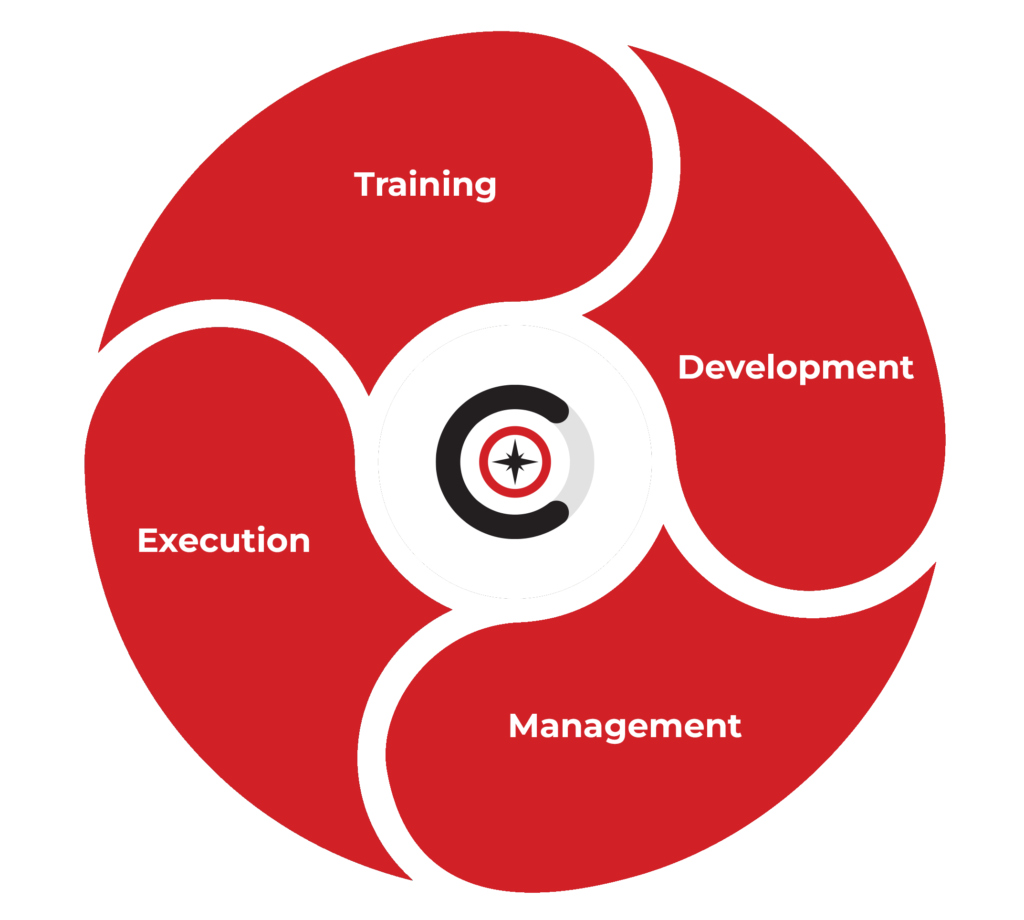

What is Education Based Consulting (EBC) Model ?

The uniqueness of EBC lies in the overall approach used to deliver the solutions. In addition to engaging with clients, assessing needs, developing solutions, implementing solutions and evaluating outcomes, the EBC model solutions are developed and executed through training, coaching, and mentoring with the primary objective of assisting businesses operating optimally in the long run. Let’s discuss how it will benefit you.

Products

Comparable Company Benchmarking Analysis

CAPAM is in the process of developing a web-based product for comparable company benchmarking analysis with the aim to generate greater efficiencies in performing transfer pricing analysis. This product will be customizable to your requirements. Stay tuned for more updates!

Testimonials

Director of TaxNew Balance Athletics, Inc.

Jonathan Cormier

I have had the pleasure of working with Jinkan on transfer pricing management for over five years. Jinkan is an expert tax professional and his in-depth tax and transfer pricing knowledge was of great value to the NB team.

He was attentive to the Company’s objectives and goals in our international operations and was able to foresee potential issues and opportunities in the transfer pricing methodologies being applied. Over the years Jinkan made many recommendations that have supported the growth of our international business.

Jinkan’s vast knowledge of both US transfer pricing law as well as OECD guidelines is apparent, and he was able to pass this along to the NB team while challenging us to focus on the underlying economics in our cross-border transactions. Jinkan is a trustworthy and engaging professional who has been a valuable asset for the NB team.

He was attentive to the Company’s objectives and goals in our international operations and was able to foresee potential issues and opportunities in the transfer pricing methodologies being applied. Over the years Jinkan made many recommendations that have supported the growth of our international business.

Jinkan’s vast knowledge of both US transfer pricing law as well as OECD guidelines is apparent, and he was able to pass this along to the NB team while challenging us to focus on the underlying economics in our cross-border transactions. Jinkan is a trustworthy and engaging professional who has been a valuable asset for the NB team.

Global Tax DirectorOanda Corporation

Vienna Choi

"I've had the pleasure of working with Jinkan Khatadia as our transfer pricing consultant for several years. I am thoroughly impressed with his unique approach to consulting. What sets him apart from other consultants I’ve worked with is his dedication to educating his clients on transfer pricing. Instead of simply providing recommendations and solutions, he took the time to ensure that we fully understood the process and reasoning behind the strategies he developed and implemented. This approach not only led to more informed decision-making at our end, but also empowered us to confidently navigate transfer pricing regulations in the future. Overall, I highly recommend Jinkan for anyone in need of transfer pricing consulting services. His unique approach and expertise make him an invaluable asset to any business."

Tax DepartmentPopulation Services International

Nutan Chetri

I am pleased to recommend Jinkan Khatadia who helped me understand everything about transfer pricing that was relevant to my organization. As someone who has worked closely with him, I can attest to his exceptional expertise and innovative approach. He emphasized a lot on educating our business leaders which helped us immensely with optimizing taxes and mitigating risks for the company. He described the process very well and identified certain areas that we could do inhouse to save us consulting fees. His approach to consulting is truly unique where he works as a part of our company rather than a consultant.